Nepse plunges to nearly a year-low

Author: Hasana Lawaju

Category: Mountain

February 12, 2017

Everest, Nepal

Kathmandu, February 11 The domestic share market took a massive hammering in the week of February 5 to 9 as the credit crunch hit market transactions and selling pressure caused Nepal Stock Exchange

Nepse plunges to nearly a year-low

Kathmandu, February 11

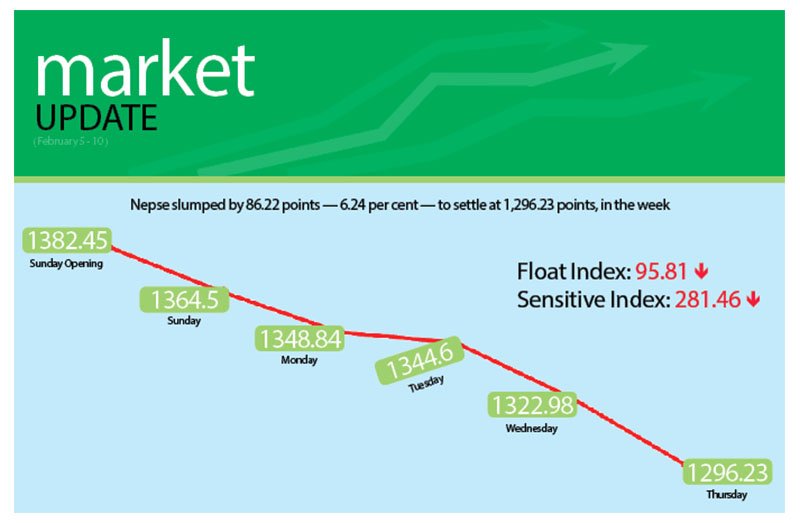

The domestic share market took a massive hammering in the week of February 5 to 9 as the credit crunch hit market transactions and selling pressure caused Nepal Stock Exchange (Nepse) index to plummet by 86.22 points or 6.24 per cent to nearly a year-low level.

The benchmark index, which opened at 1,382.45 points on Sunday, had dropped by 17.95 points by the day’s closing and continued southbound for the entire week. After dropping by 15.66 points on Monday, the local bourse shed 4.26 points on Tuesday, fell by 21.62 points on Wednesday and descended by 26.75 points on Thursday to rest at 1,296.23 points for the week.

This was the first time that Nepse index retreated below psychological level of 1,300 points since breaching the threshold on March 3.

Altogether 18.88 million shares of 156 companies worth Rs 1.74 billion were traded through 20,005 transactions during the week.

The secondary market had witnessed transaction of a whopping 15.41 million shares on the last trading day of the week. The weekly traded amount, however, was 21.47 per cent less than the preceding week, even though the market had remained open for only four days due to public holiday back then compared to the normal five trading days of the review period.

In the past week, 20,660 transactions of 5.95 million shares of 156 firms that amounted to Rs 2.21 billion had been undertaken.

The sensitive index, the marker for the performance of class ‘A’ stocks, dropped by 18.89 points or 6.29 per cent to 281.46 points. Similarly, the float index that measures the performance of shares actually traded also fell by 6.65 points or 6.49 per cent to 95.81 points.

Whereas manufacturing and trading remained steady at 2,161.86 points and 206.16 points, respectively, the rest of the subgroups wound up in the red.

Insurance subgroup saw the biggest plunge of 677.68 points or 11.18 per cent to 5,380.87 points. Share value of insurance companies like Life Insurance Co Nepal slumped by 15.57 per cent to Rs 1,931 and Nepal Life was down 7.37 per cent to Rs 2,200, among others.

Hotels took a dive of 140.22 points or 7.93 per cent to 1,628.13 points because of Soaltee losing 10 per cent to Rs 261, Taragaon Regency down nine per cent to Rs 192 and Oriental dipping by 0.86 per cent to Rs 460.

Banking saw the previous week’s gain of 1.89 per cent wiped out as the subgroup plummeted by 87.26 points or 6.54 per cent to 1,245.97 points. The sub-index was weighed down as commercial banks like Nabil lost 5.84 per cent to Rs 1,370 and Standard Chartered closed at Rs 1,908, down 8.71 per cent.

Finance dropped by 29.29 points or 4.59 per cent to 609.14 points, weighed down by, among others, Citizen Investment Trust falling by 7.93 per cent to Rs 3,020.

Similarly, hydropower lost 68.6 points or 4.24 per cent to 1,549.3 points, development banks fell by 61.43 points or 4.23 per cent to 1,388.98 points and others closed at 680.24 points, down 17.35 points or 2.49 per cent.

Meanwhile, Prabhu Bank topped the chart in terms of weekly transaction and turnover — 1,457 transactions and Rs 109.49 million. The other listed companies to make to the list of top-five in terms of traded amount were Nepal Life Insurance with Rs 77.81 million, Deprosc Development Bank with Rs 74.09 million, Nepal Investment Bank with Rs 61.59 million and Everest Bank with Rs 57.41 million.

Siddhartha Equity Oriented Scheme was the forerunner in terms of trading volume with 5.676 million of its scrips changing hands.

Weather Update: Standard Himalayan mountain conditions

Peak Altitude: 8848 m

Risk Level: Low

Expedition Info: First ascent expedition

Mountaineering

Himalayas

Nepal

Adventure Sports

Everest

First